One of the most popular ways to achieve financial freedom is through dividends. There’s a good reason for that, too. Dividends are a very convenient and steady way to earn passive income. No shares of stock have to be sold for this, but one benefits from the profit distributions of the companies. Once you have the stock in your portfolio, all future payments automatically go into our account. This should form the basis for our goal.

What do you want to achieve?

Depending on whom you ask, the concept of financial freedom can mean something completely different. To begin with, you should be clear about what financial freedom means to you and how you want to achieve it. For our goal, we define financial freedom as follows: We want to be financially independent i.e. all running costs should be covered by dividend income. In our example, these running costs consist of rent incl. utilities, food costs, insurance, gasoline costs, cell phone, internet, restaurant visits and an amount for miscellaneous. Via the miscellaneous amount we can create a buffer for e.g. vacations, workshop visits or other irregular payments. To get an accurate value here, you should monitor your expenses over the long term and write them down. In the end, you will get an amount that reflects your monthly expenses. We set this amount as a target value.

Set a deadline

Next, you need to think about what a realistic deadline might look like. This will depend on your circumstances. Do you already have dividend shares or is your securities account still empty? How much can you invest in stocks each month? Do you prefer high dividend stocks or is sustainable dividend growth more important to you? You should find a suitable strategy for yourself, if you don’t already have one, and then define an approximate deadline based on it. You don’t have to give a perfect estimate, the time should just be realistic. Because with a concrete time by when you want to have reached your goal, you motivate yourself more strongly to act than without a deadline.

The concrete goal

With this information we can now define our goal.

It could be as follows: “I earn 1,000 $ per month through passive income streams in form of dividends and can use this to cover my running costs. I will achieve this by 31.12.2030.” Your goal will now accompany you for a long time. It is best to formulate it personally, positively and in the present tense.

Measure your progress

Now we deal with the progress of our goal. After all, you should know if you are making good progress and when you will reach your goal. Besides, it’s motivating to see how you’re getting closer to the finish line bit by bit. To do that, you need to find concrete metrics that you can use to measure progress.

For our goal, a first key figure could be cost coverage. It determines how much of the, for example, required 1,000 $ for monthly fixed costs we already receive through dividends. We use a target key figure for this and set the target value to 1,000 $. We set the dividend income generated on average per month as the current value. If we reach 100% here, i.e. 1000 $, the goal is complete!

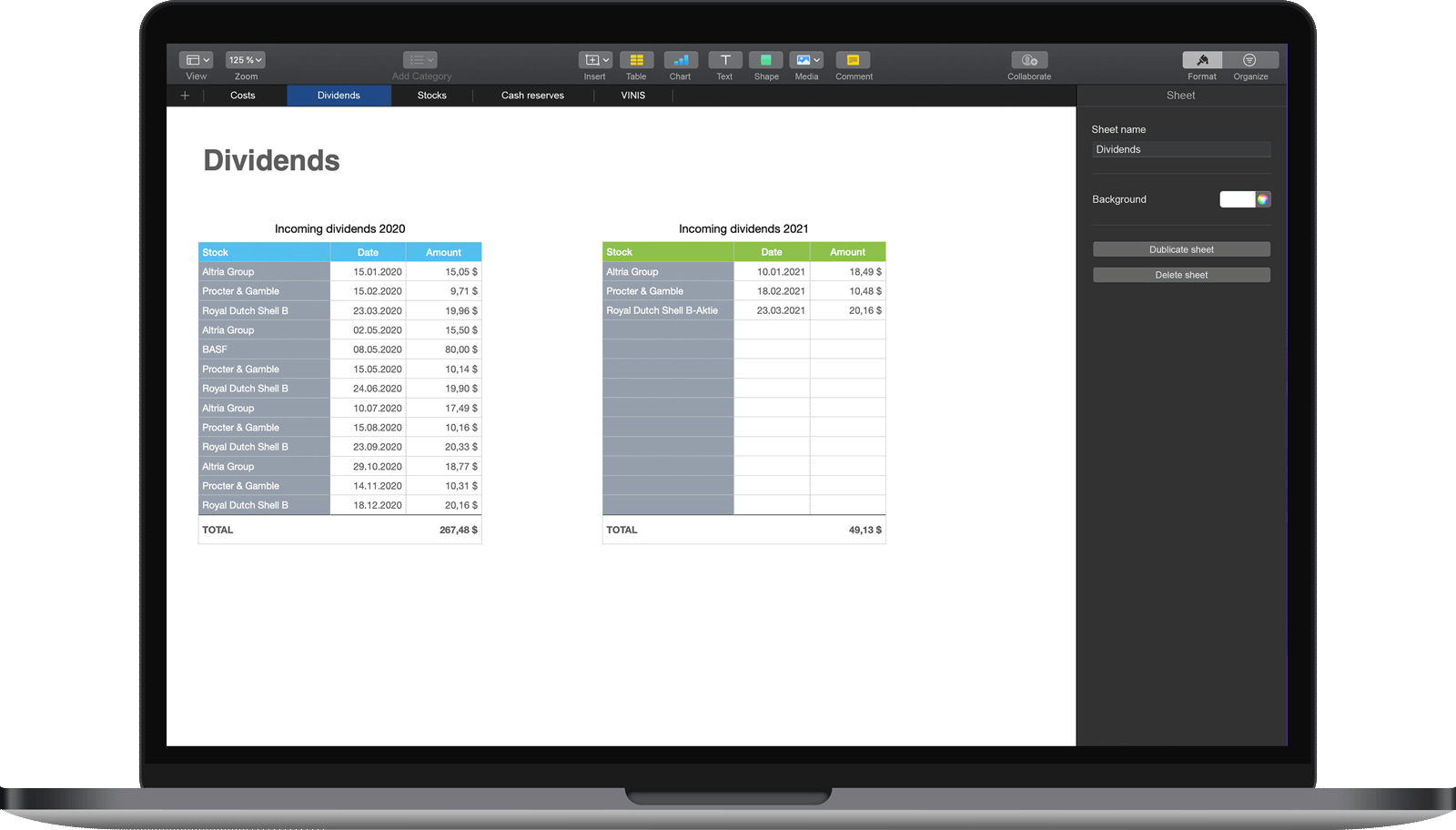

Another key figure that shows us how well we are progressing is the percentage dividend increase compared to the previous year. Here it is a good idea to use a growth key figure. The original value is the annual dividend received from last year. As current value we need the dividends from this year.

The overall performance of the stock portfolio and your cash reserves for further stock purchases are also interesting values to keep an eye on. For the portfolio performance, we again use a growth key figure. Here, we take the purchase value of all stocks as the original value. The current value must reflect the current value of all shares. For our cash reserves, we take a simple value key figure that just shows us the current value.

Data collection

We have now defined key figures with which you can easily keep track of the progress of your goal. What is missing now is the data for your metrics. The easiest way would be to enter them directly into the app. In the long run, I would recommend switching to an external tool. One possibility would be to use Excel or Numbers and create a document where all financial data is collected and maintained. Here we would like to support you and provide you with an Excel and Numbers template. With this you can fill all key figures from the target template.

Our flexible key figures allow you to access external data from the VINIS app. You just enter new values in the document and the VINIS app can retrieve and update this data via an automated export. You can find instructions on how this works here.